Mid-term Business Plan

24Medium-term Management Plan(fiscal years 2024-2026)

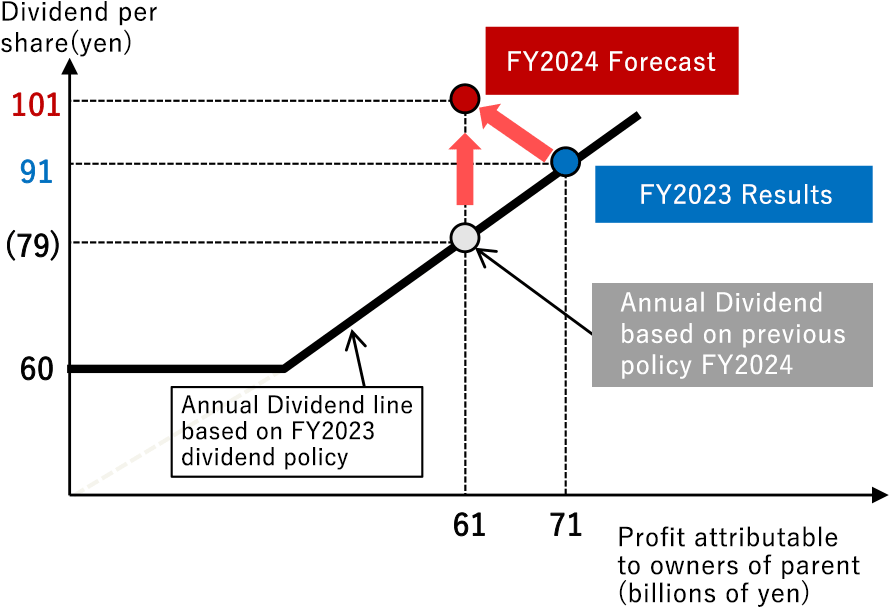

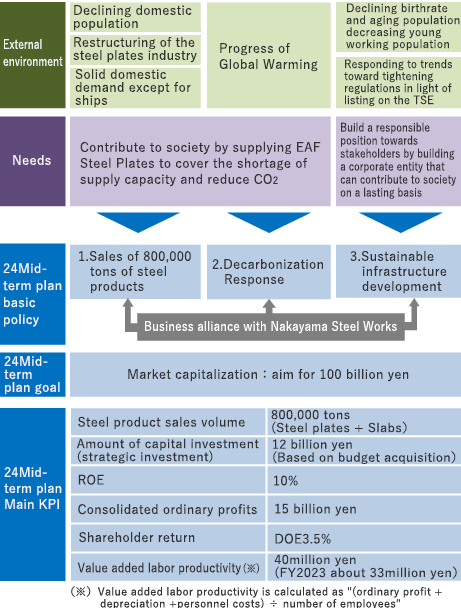

Based on the changes in the external environment surrounding our company and the needs of society, we have set the goal of our 24Medium-term Management Plan to "aim for a market capitalization of 100 billion yen." We will promote various initiatives in accordance with our three basic policies: "Sales of 800,000 tons of steel products," "Decarbonization Response," and "Sustainable infrastructure development," while effectively utilizing our business alliance with Nakayama Steel Works.

24Medium-term outline

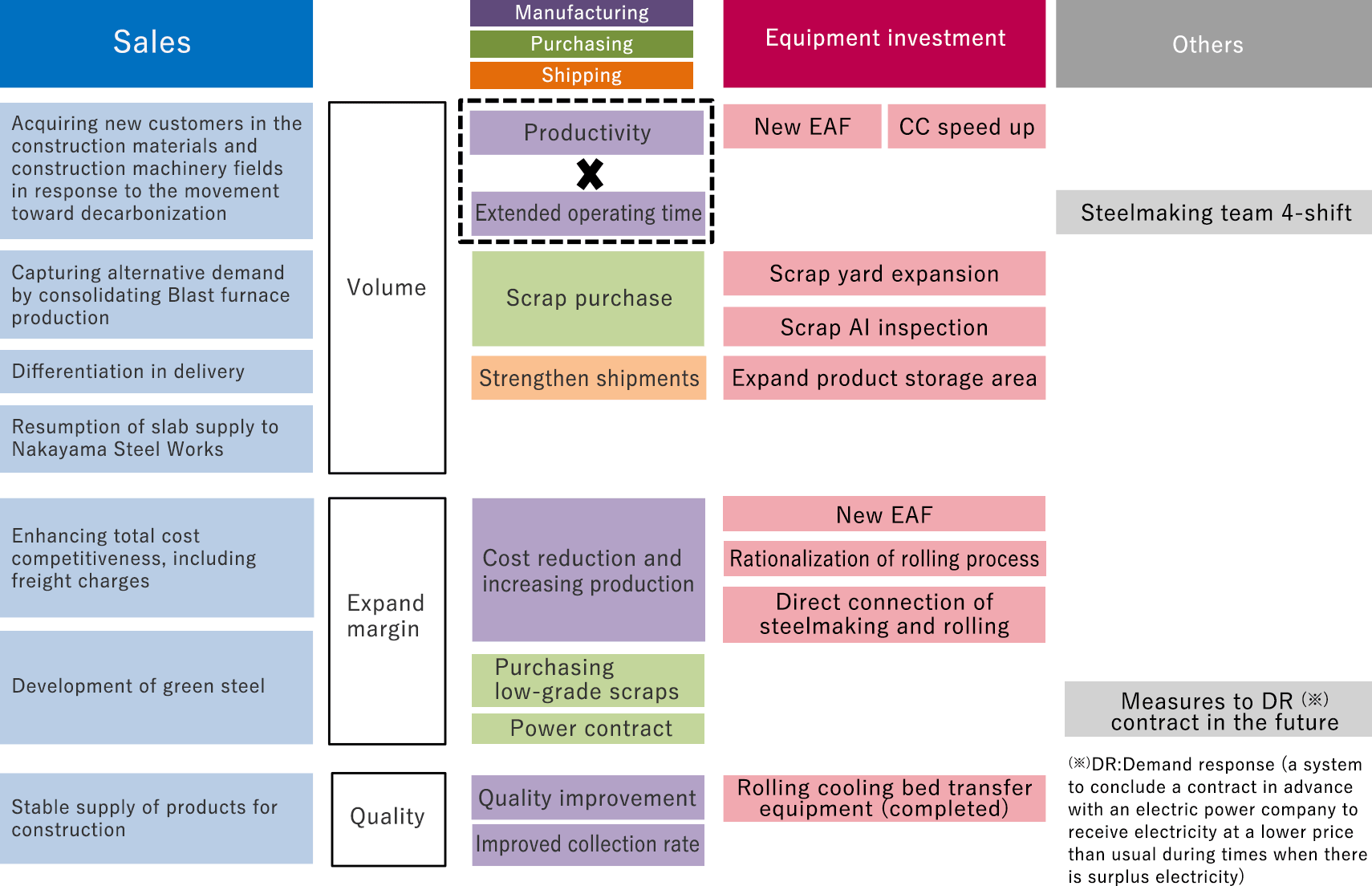

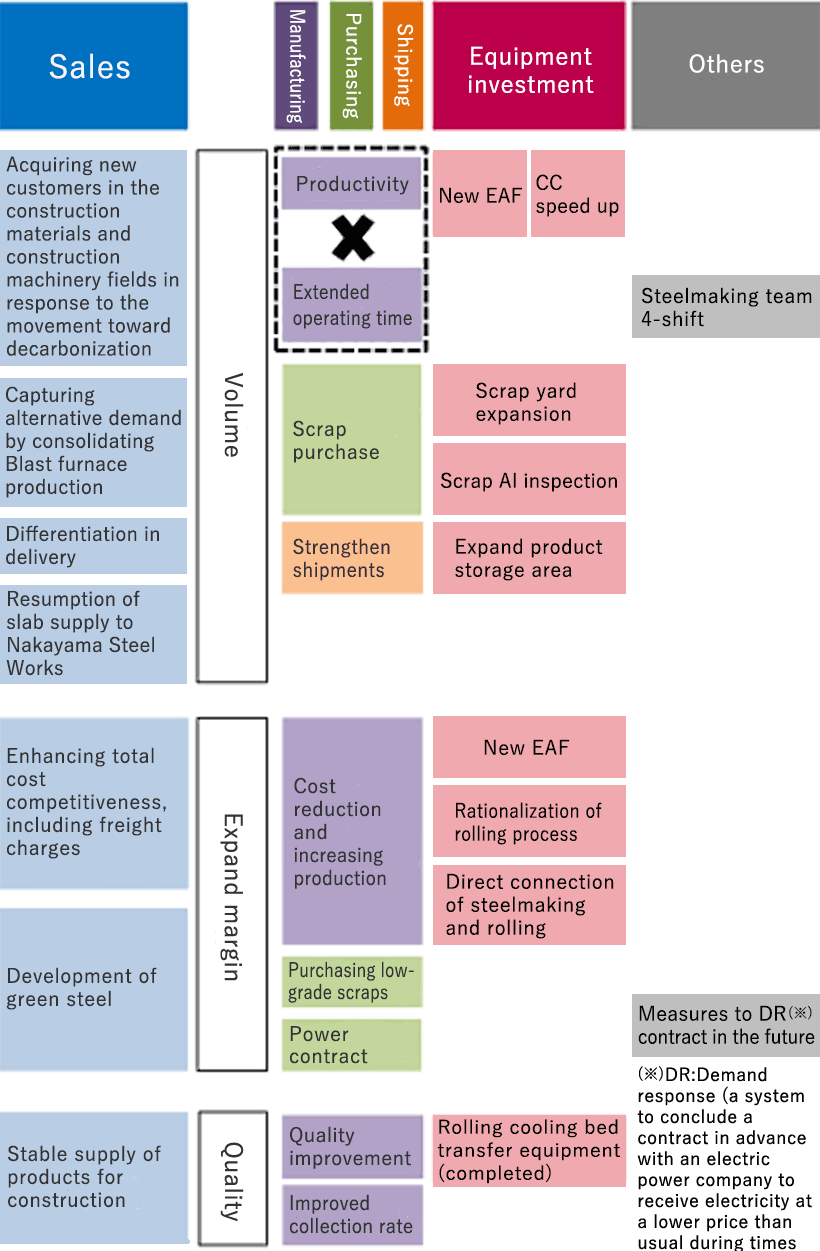

1. Sales of 800,000 tons of steel products

In addition to capturing alternative demand of reduction in supply of steel plates due to the consolidation of production facilities resulting from structural reforms in blast furnace manufacturers, and to meet the increasing decarbonization demands from users expected in the future, we will strive to enhance our manufacturing and sales structure to increase the sales volume of steel products to 800,000 tons.

To maximize productivity improvements from the update to the new electric arc furnace (scheduled for autumn 2024), we plan to invest approximately 12 billion yen over three years in strategic initiatives such as enhancing the productivity of continuous casting (CC) facility and expanding the scrap yard and product yard.

We will also promote further energy savings and cost competitiveness through increased production, as well as the development of green steel based on the CO2 emission reduction effects associated with the operation of the new electric arc furnace, aiming to acquire new users through proactive sales activities.

Overall Structure of Sales Growth Strategy

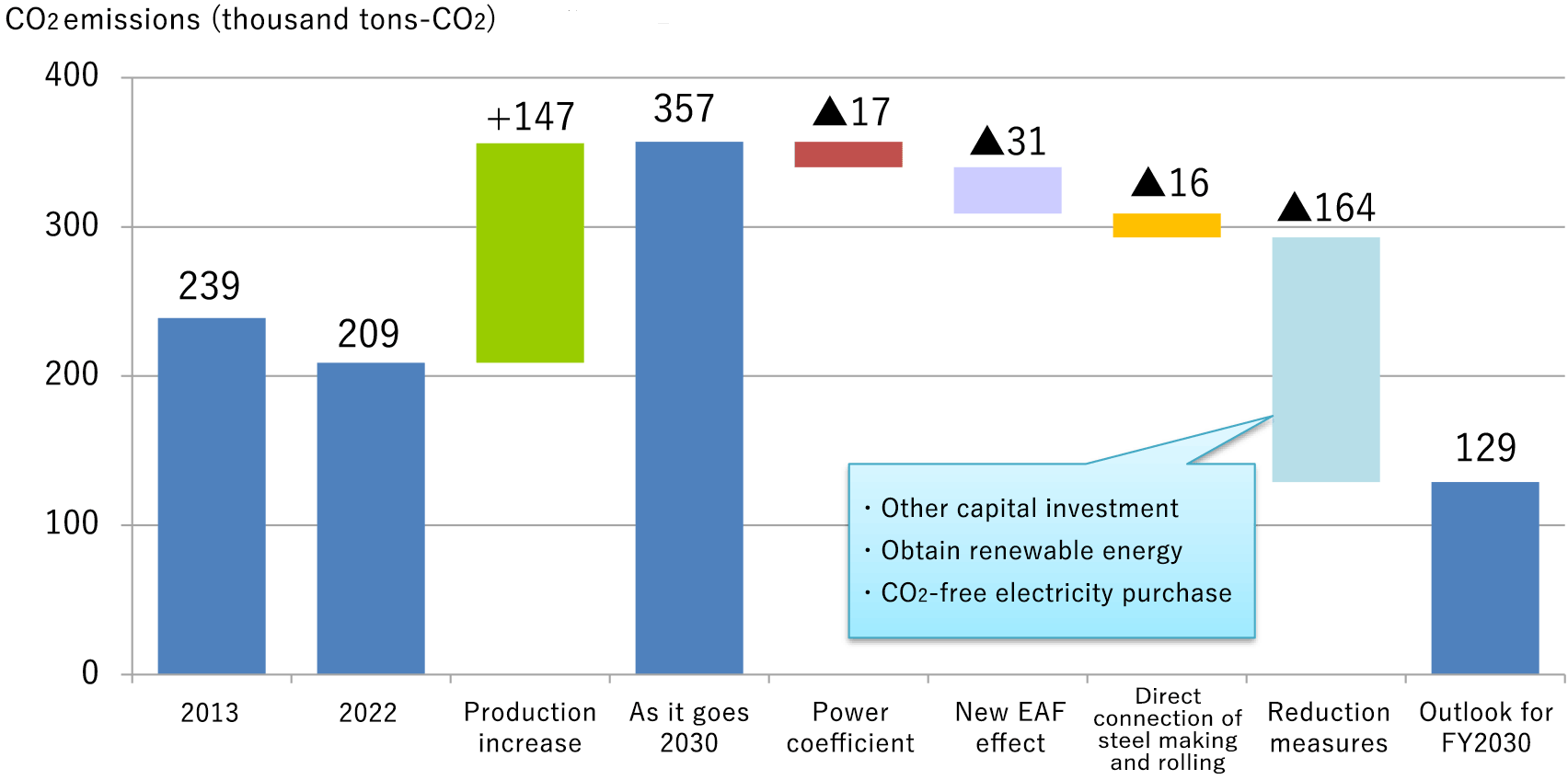

2. Decarbonization Response

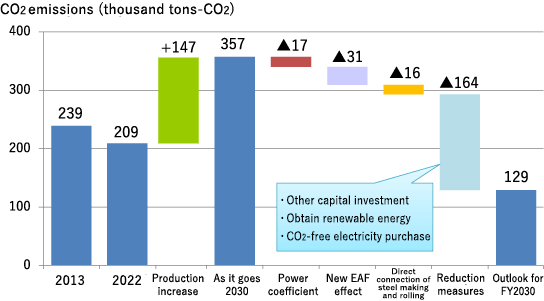

Our company aims for "carbon neutrality by 2050" and is targeting a 46% reduction in greenhouse gas emissions by fiscal year 2030 compared to fiscal year 2013. To achieve this, we will promote CO2 emission reductions through energy-saving effects from new electric furnace, as well as investments in energy-saving equipments and acquisition of renewable energy. Additionally, we will strive to enhance our information disclosure in line with the GX League and the Task Force Climate-related Financial Disclosures (TCFD) recommendations.

| Items | Main Initiatives |

|---|---|

| Promotion of energy-saving equipment investment |

- Reduction of melting power consumption through the utilization of new electric arc furnace effects - Reduction of fuel usage in heating furnaces by directly connecting steelmaking and rolling processes - Promotion of energy-saving investments through the establishment of an internal carbon pricing system |

| Acquisition of renewable energy |

- Introduction and expansion of off-site Power Purchase Agreements (Off-site PPAs) - Purchase of CO2-free electricity |

Roadmap for CO2 Emission Reduction

3. Sustainable infrastructure development

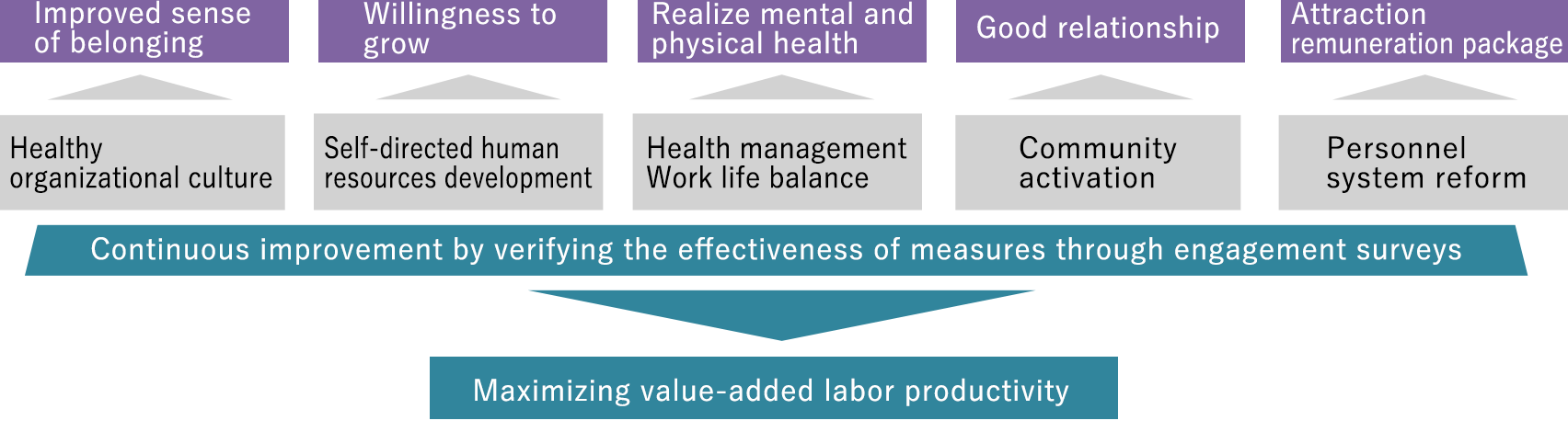

To enhance the vitality of employees, which is the most important foundation for supporting growth, we will further strengthen our human capital strategy. In addition, we will advance various initiatives such as DX strategies aimed at improving operational efficiency, strengthening governance, risk management, and compliance, efficient balance sheet management, as well as measures related to the environment, disaster prevention, business continuity planning (BCP), and subsidiary strategies. These efforts will accelerate the establishment of a corporate foundation aimed at achieving long-term growth.

Overall Structure of Human capital strategy